College-bound students are presented with an exciting (yet somewhat tedious) checklist in the march towards higher learning. Narrowing college options and completing admissions applications mark the beginning. Once students have committed to a college and completed the Free Application for Federal Student Aid (FAFSA), it’s time to crunch numbers.

Charting a Path from FAFSA to Tuition

The distance between receiving FAFSA eligibility and paying that first tuition bill can be traversed by many different routes. At UNC Greensboro (UNCG), the Financial Aid department is the “Google Maps” equivalent for Spartans determining how to pay for college.

If you don’t know the way, consult Financial Aid early, so they can help you make a plan that works for you and your family. But first, consider the following questions to help you determine the best route for your specific journey.

1. Are there Other scholarships that I qualify for?

Students who complete FAFSA applications will be notified of all state and federal funding they are eligible to receive, but this doesn’t include private scholarships.

There are search tools online that can help you find national scholarships to apply for, but these are highly competitive. John Lucas, director of Financial Aid and Scholarships at UNCG, recommends students search their local area for privately funded scholarships from businesses and private foundations.

“Many of our donor funded scholarships have specific requirements which can make it difficult to qualify for these awards. High schools are notified of scholarships available to college-bound seniors, so incoming freshmen should start there,” he advises. “Financial need and merit are the biggest qualifiers driving selection criteria.”

Applications and interviews may be involved but approach the project like you would a job search that could yield a nice pay-off toward educational expenses.

2. Should I consider a student loan?

Lately, there’s been much buzz about the weight of student loans, but Financial Aid cautions students to not immediately disregard this option. For some, it’s a worthy investment in a promising future.

Student loans are guaranteed by the government without a credit check. The key is to consider the impact of interest rates on what you’ll owe when you finish college – specifically six months after graduation.

For some students, it makes sense to defer payment until school is behind them. Rather than stressing about the financial burden while in college, these students prefer to pay the loans back with interest when they are earning a substantial salary.

Lucas debunks the worry that terms for student loans are ‘set in stone’ for all four years and emphasizes that flexible options should be considered based on your changing financial status.

“It’s up to the student to decide if she wants to accept the full amount of the loan, decline the loan, or accept a smaller amount to cover what she needs,” Lucas explains. “The good news is once you make your decision – even if you accept the full amount – you can decide later that you don’t need it, and the loan can be reduced. Many students decline a loan because they aren’t aware that they can accept a smaller amount.”

3. Should my parents consider a loan

For dependent students whose parents are helping to fund education, PLUS loans are the next tool in the box. Because of their age and economic status, parents qualify for different loan terms than students.

A credit check is required to determine a parent’s terms and benefits, but if parents apply and are denied, dependent students will then qualify for the equivalent of an independent student’s loan amount.

PLUS loans have reasonable interest rates, and long-term repayment options keep future payments low. Like student loans, payments can be deferred while students are enrolled, but interest payments will apply.

“A parent who’s trying to figure out how to pay for their first child to go to school might be having a different conversation at home than if it’s a third child,” warns Lucas. “And this is why options are important for students and their parents.”

Lucas offers this advice: when debating a parent versus a student loan, consider how much your parents make now versus how much your starting salary will be after graduation. Check out the PLUS Loan Application Instructions on Spartan Central before the loan applications open in June.

4. Should I use a payment plan to spread the cost of tuition over time?

If the thought of interest rates and deferred payments makes you nervous, the Cashier’s Office has another option to make educational funding more palatable. Consider UNCG’s payment plan options.

Payment plans allow families to pay tuition in monthly installments throughout the semester rather than in one lump sum. While no interest rates apply, there is an enrollment fee. This option can be used when money is tight for a shorter period of time. Consider payment plans to bridge income gaps or if you are balancing your studies with a job to pay for tuition.

5. Should I work while I’m at school to help pay for my education?

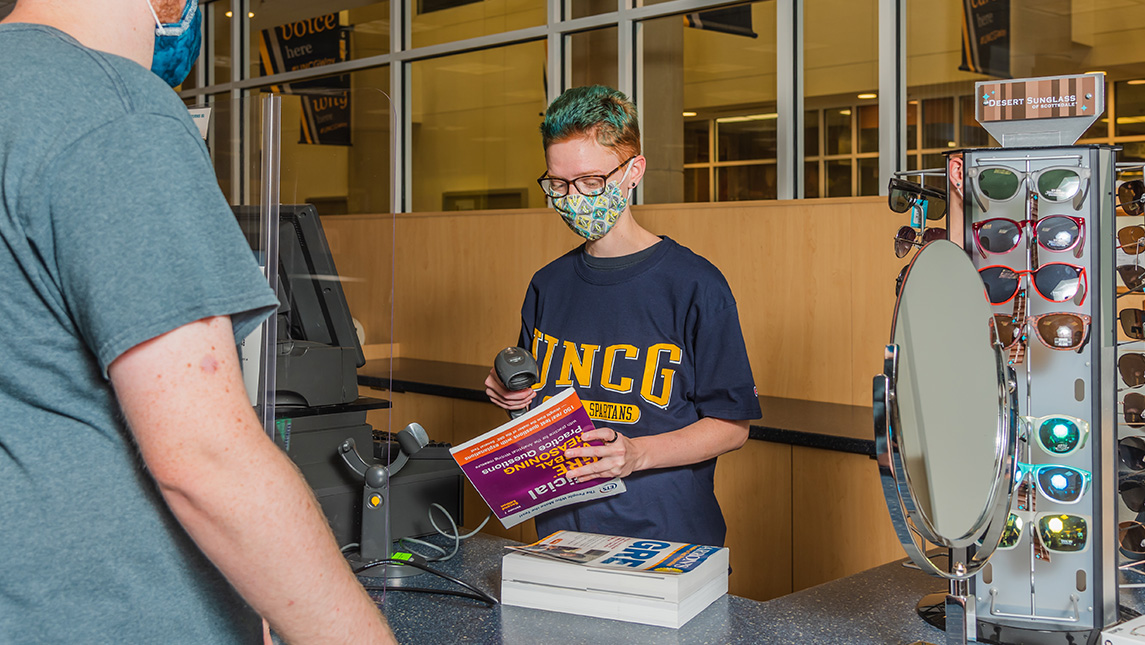

Whether or not students need to work to pay for their tuition and expenses, working is usually beneficial. Part-time jobs are a great way to establish social and professional connections, improve time management, and get a jump on career-building experience. Students can consider on- and off-campus jobs.

Federally funded work-study positions exist at UNCG, but the program only employs about 2 percent of our students. Outside of this small program, other jobs are available to students within different university departments. Consult the Career and Professional Development Center for more information about work-study jobs and other campus positions.

Lucas explains, “I don’t want a student to say, ‘Oh, I didn’t get a work study position. I guess I can’t work on campus.’ No, you still can. Continue to look for jobs if you want to work.”

Beyond campus jobs, UNCG’s convenient location and Greensboro’s public transportation offer many opportunities for flexible part-time work around the city that can enhance your professional networking as well as help fund your college expenses without interrupting your studies.

NAVIGATING A ROAD TO SUCCESS

As you consider the journey ahead, take heart that you have already made a solid financial choice. UNCG was recently ranked #1 in North Carolina for net cost by the New York Times.

In Chancellor Gilliam’s December 2022 commencement address, he noted that 51 percent of UNCG’s graduating class were first-generation college students, 63 percent received financial aid, and 80 percent worked while pursuing their education. This is a testament to the hard work and resiliency of UNCG’s students. But it also demonstrates the ways UNCG’s staff and departments like Financial Aid provide routes for students of all kinds.

As you begin to map your way, find explanations and instructions on Spartan Central that walk you through financial aid applications and responsibilities of each benefit. Use the Bill Estimator Tool to kick off your number crunching, discover the All Types of Aid page with deeper dives into the options discussed in this story, and find multiple ways to contact financial aid representatives at UNCG. They can answer specific questions and make sure your road to educational funding is a smooth one.

Story by Becky Deakins, University Communications.

Photography by Sean Norona, University Communications.